“What can we buy?” This was what most prospective home-buyers asked. It was the wrong question. The right question to ask was “what should we buy?” Or, “should we buy at all?”

For us it didn’t make any sense to buy, even though we had zero debt, enough cash, and liquid assets. “Cash” sounded great in years when the markets were down, but it was the worst possible situation during times of super-inflation and every equity market at record highs.

So we needed a place to put our cash to protect it from inflation. Was an expensive house the right place? My instinct told me no, at least for where we had chosen to live.

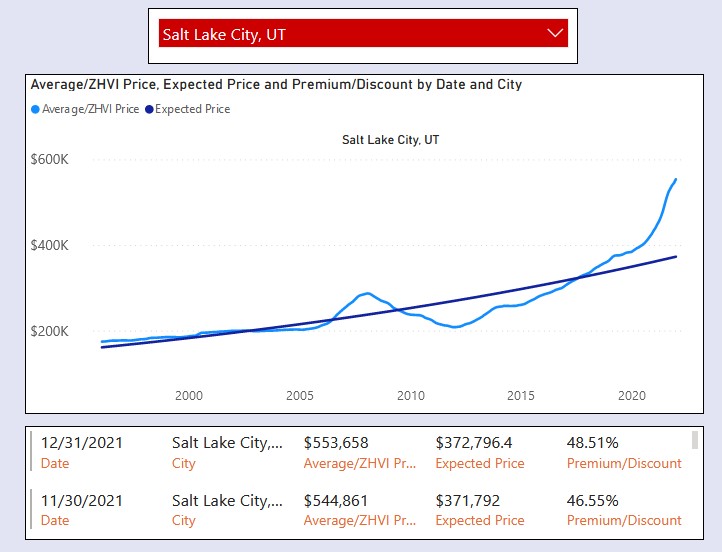

The featured image showed Federal Reserve Economic Data (FRED) on the median sale price of a house over time, as of 2020. It would shoot up another 25% to around US$600K by the end of 2021. This was the median price for all Salt Lake City. In communities where people actually wanted to live, it was closer to US$800K.

So was it cheaper to dump our cash into an eight hundred thousand dollar house, or was it cheaper to rent a house worth that much? As it would happen, my brother’s friend owned a house valued at US$800K around the corner from us, and he wanted us to rent it. We were probably in the top 5% of most reliable renters in America, but when I spoke to the landlord it felt less like a renters’ market and more like a prospective tenant’s market.

They wanted US$3000 per month for the place, and they were giving us a discount over what they’d charge strangers. We were a single income household (sacrificing a second income for parental childcare), so this rent would put us in the “distressed” housing category, paying more than 50% of our pre-tax income on a place to live. However, it was nothing unusual around here and it kept us in the neighborhood where the kids went to school and our friends lived. Plus, we had cash that was burning up due to inflation, and we had to spend it somewhere. Was it better to pay a landlord’s mortgage, or our own?

Rent versus buy on a US$800K house, monthly expense.

Rent: $3K. This included the water bill.

Buy: there were a couple ways to go here. Buy it all or pay the minimum. For now, I’d go with the minimum, 20% down on a fifteen-year mortgage, as we were not staying in the U.S. more than fifteen years.

20% of $800K was $160K down, so we’d take out a $640K loan. According to an amortization calculator I found online, this would be around $1800 interest per month, plus $2700 toward the principal. So, $4500 per month. (This payment alone was more than our total after-tax, after retirement investment, monthly income.)

$1800 interest per month was throw-away money. So was an estimated $500 per month maintenance, $500 per month property tax, and $100 per month property insurance.

Not to mention there would be at least $25K in closing fees, amounting to an extra $140 per month for FIFTEEN YEARS!

Total throw-away money to buy: $3040 per month.

Total throw-away money to rent: $3000 per month.

And these calculations assumed that housing prices would continue to go up forever, which seemed like an unsustainable economic situation.

It wasn’t very often that equity markets shot up 50% in two years. I was betting on a crash, and so was everyone else.

Everyone we knew who wasn’t a current home-owner was in the exact same situation. They preferred to rent over own. One family we knew finally gave up settling here permanently, and moved back to Japan. Some other friends of ours moved to rural Vermont. These was anecdotal examples, but a good sign of what was to come. Housing price had outpaced household income for decades, the gap between what people earned and the cost of living continuing to rise. In Salt Lake, it median home price to median household income was around 10:1.

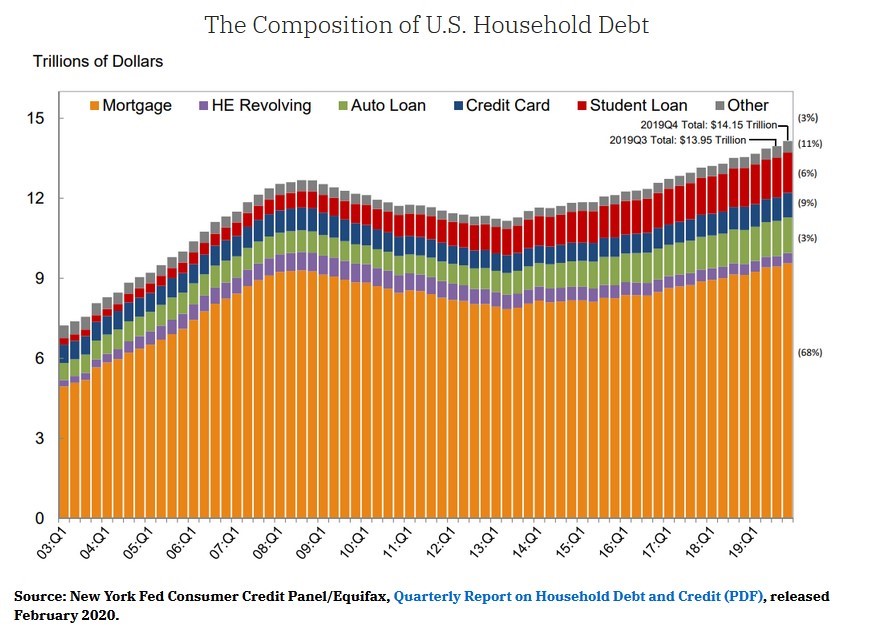

It was no surprise to see American household debt was at an all-time high as of early 2022.

The last time household debt was this high was in 2007, and around that time I visited my dad in Las Vegas. He had lived there many years, and was looking for a house to buy. We went around with a realtor together, and she made a statement that would stick with me forever: “I don’t know how people are avoiding these prices. I guess they’ll just have to make more money. That’s how the economy works!”

I was no economist, but the real estate agent’s comment was jarring. Sure enough, a year later the housing market crashed through the floor nationwide. There would still be houses in Las Vegas underwater fourteen years later, worth less than the original price. The Las Vegas realtor was nice, but I would always remember her as one of the biggest idiots I had ever met.

In early 2022 the atmosphere in Salt Lake City felt the same.

We had done the math. It was still cheaper to rent, even considering skyrocketing rental rates. Why pay someone else’s mortgage when you could pay your own? Paying rent was throwing money away? These old adages no longer applied. So yeah, we were happy to pay someone else’s mortgage until the bottom fell out of the market, or for as long as it made sense.