Housing is not a right…

The other day I went to the local hardware store to buy a 1’ x 6’ board to make some shelving. At the register I was shocked to find this single plank of wood cost US$65. I took it back to the lumber section and asked them to cut it in half. Three feet would do. Back at the register, I remarked to the cashier, “Holy crap, wood is expensive! Good thing I’m not building a house.”

“You can thank the president for that, honey,” she replied.

At first I thought she meant the president of the hardware store company, but then realized she meant the President of the United States. For a moment I couldn’t even remember who the president was. Did it matter? I had lived overseas for a decade and had never given it a second thought.

I disregarded the cashier’s comment as typical American political polarity, but decided to research it when I got home.

As it turned out, the cashier lady was not incorrect. According to an article on NPR, the previous president had jacked up tariffs on Canadian lumber, America’s number one source of foreign wood, to about 9%; but the current president had double-downed on this move, raising the tax on Canadian wood to almost 20%. This gave the American lumber industry a virtual monopoly, so they could sell it at any price. And if an industry could sell something at any price, well, then things got expensive, and the hardware store could charge sixty-five freaking dollars for a single board of wood.

The NPR article related these facts in an apologetic kind of way, because, presumably, even to a news outlet that could be expected to support a Democratic administration this seemed insane.

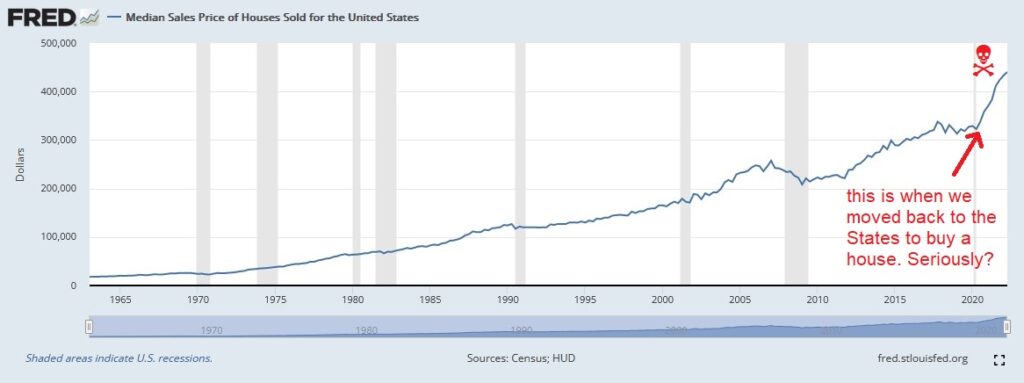

We were in the middle of a full-blown housing affordability crisis in America. Housing prices in many American cities (including the one to which we had decided to move) had tripled in the past decade (TRIPLED!), mainly due to low supply, and supply would not increase if building costs were high.

The current level of housing inflation was unprecedented in all of American history. Was this really the best time to jack up tariffs on foreign lumber? The U.S. lumber industry must’ve had some damned good lobbyists, was all I could conclude.

The apologetic NPR article attempted to end on a positive note, stating that at least the current administration was pushing the multi-trillion-dollar “Build Back Better Plan,” whatever that was. How were they were going to build anything back better with lumber prices through the roof?

For me, this topic hit much deeper than the price of a single board of wood. I was on a twenty-seven-year employment streak. Every weekday for the past quarter century I had done the exact opposite of what I wanted to do. For ten years straight I had dragged my physical meat mass through a two-hour round-trip commute aboard the trains of Tokyo metro to serve my daily sentence as a wage slave. Every day for a decade I had grit my teeth, gazed down at the tracks as the train approached, understanding why some chose to end it all. But I got through it.

Two prevailing ideas had kept me off the tracks and repeating this routine for five hundred consecutive weeks: one, my extra “hardship” pay allowed my family to enjoy a unique life in one of the best communities in Japan; and two, I was saving enough to buy a house in America when we finally moved to the States.

Housing was a basic necessity, but it was not a right.

Still, I couldn’t help but feel I deserved the opportunity to buy a house for my family at a price that would not jeopardize our financial future. I was probably in the top one percentile of most financially responsible people in America, having maintained steady income for three decades and provided for my family without incurring a single penny of debt. Hadn’t I earned my way into decent housing at a fair price?

It was entirely possible that my sense of entitlement came from a financial worldview that was no longer the norm. In my world, debt was bad. In the real world, debt was good. Everyone was in debt. Low-interest debt allowed financially average people to “own” a big house. So what if the loan was eight times what your household made in a year, if monthly payments were low?

Even cold, hard math favored debt. In a lot of cases it was just cheaper to maintain massive debt than it was to pay off a house in cash. But life wasn’t all about math. Sometimes it was worth paying more to have the feeling of actually owning something (as opposed to claiming you “own” when you were really paying rent to a bank). Actual ownership also massively lowered monthly expenses, allowing for more financially flexibility and opportunity in life.

For a long time there was this old adage, probably started and propogated by real estate agents, that used to be true in most cases: renting was throwing money away. In early 2022, even with elevated rents, this was clearly no longer true.

I did the math on a few rental houses in our neighborhood, each listed at about US$800K, and determined the throw-away money in buying a house was actually more than the throw-away money of renting the house. There was the maintenance cost, the property tax, the insurance, and all interest stacked in the first decade of a thirty-year loan.

Not to mention that we were at the peak of a titanic housing bubble. It was one thing to buy now with the funny money of inflated housing equity on the sale of your old house, but we were basically first-time home-buyers again. A 20% drop in the housing market seemed an imminent (and perhaps conservative) occurance, which for us would mean kissing that cash down payment goodbye. That was the equivalent of a college education for one of our kids that would take a decade or more to recover. We may have had the money to buy, but we also had brains.

In most cases, “owning” a “home” was fundamentally the same thing as renting anyway, except more expensive and less flexible. Banks owned two-thirds of American homes, so in most cases renting was like paying a middleman, a landlord who skimmed a few percentage points off our rental payment before giving the rest to the bank. In exchange, we renters enjoyed a tax-free, insurance-free, maintenance-free, hassle-free living experience.

These were the kinds of things I told myself during the biggest housing bubble in all of American history. Things were changing fast, and I believed they were changing to favor first-time home-buyers like us. Interest rates were going up, and residential real estate sales were going down. Soon the prices would go down, too.

In a year things would look much different indeed!